Curve Card: Is It Suitable for a Traveller?

The content on this page includes affiliate links. While clicking on these links won't cost you anything extra, we may earn a modest commission from any purchases you make.

Curve Card helps to save money, especially among travellers. Read our review to find out how we have benefited from Curve.

Covered in the Article

Curve Mastercard

We have been using the Curve debit card for many years and are happy with its modern features. In this review, we tell about our own Curve experiences and analyse the card from a traveller´s point of view.

The article contains a promo code.

Is Curve a Credit Card?

WhenCurve was launched in 2018, it only featured a Curve Debit card. However, in October 2023, Curve launched an additional product - the Curve Credit card. Both types of accounts have mostly the same benefits except that Curve Debit customers do not have Section 75 protection, and Curve Credit customers are not able to use the "Fronted" feature of Curve. You can't buy or pay anything with a Curve card alone, instead, at least one right credit or debit card is needed to be linked. Curve Standard is a free payment card that conveys a payment transaction to another card set in advance by the card user. For example, with the combination of Curve and Bank Norwegian credit card, the transaction is executed in Curve, which forwards the payment in real-time to Norwegian's credit card.

Since Curve is not a traditional card, almost anyone living in the European Economy Area (EEA) can order it online. A London-based company which was founded in 2015 is behind this card. A curve card is a genuine plastic or metal card bearing the same features as all bank cards have, it is PIN-code enabled and it has a contactless payment feature. All the settings of the card can be managed easily through the application installed on a mobile phone. The card can be used on the internet and physically on almost any Mastercard-approved shopping site just like a regular card.

Curve is based in London, thus it declares some of the fees and limits in British Pounds. However, a user may select his/her card's transaction currency from multiple options. For example, residents within the EEA can set euros as their payment currency which can be easily customized through the Curve app.

Benefits of Using Curve

We have been using the Curve card for a long time and based on our experiences, here are the benefits of using Curve.

Multiple Cards Managed by Curve App

To holders of multiple payment cards, Curve is an excellent tool. The card user can pay all purchases with the Curve card and choose from the application to which preferred card should the transactions be sent. The selected card can still be changed or customized later in case of a change of mind or an honest mistake of choosing the wrong card while paying. The correction can be made within 30 days after the payment transaction. Let's simply put this, you have set in your Curve application, that you have 3 payment cards, cards A, B, and C. You made a transaction that is supposed to be billed to Card C instead of Card A. No worries about this, you can still make corrections by simply using the Curve app. You have 30 days after the time of the purchase to make such a correction.

This feature of the Curve card is useful, especially for those who have credit cards, work cards and perhaps a common card among couples. You can always pay for a purchase with Curve, and choose from the application beforehand or afterwards to which card it will be charged.

Debit Fronted Credit

With Curve, you can pay with a credit card even in stores that accept only debit payments. The curve itself is a debit card that can forward the transaction to an underlying credit card.

This feature comes with an extra 1,5% charge when paying government fees.

Spending Statistics

The Curve app provides clear statistics as to where money was spent. By using categories, the app shows how much money has been spent on, for example, travel, entertainment, groceries food and drinks etc. At the point of purchase, the retailer forwards the information to which category the purchase belongs. Using this information, Curve knows how to make statistics about money spent by a particular card user.

Cheaper Currency Conversions

For purchases either with a debit or credit card whereas paying the transaction with a currency outside the card's primary currency, the bank converts the amount into your card's currency using agreed exchange rates. On top of this, a regular bank also charges an additional conversion fee of about 2%. Curve offers almost free currency conversions on bank days. It handles the currency conversion on behalf of the underlying card's bank by using Mastercard Exchange Rates without any supplementary fees. Mastercard rates are close to the interbank exchange rates.

Outside the bank days, Curve applies a Weekend Fee from 0.5% to 1.5%.

In our case, we are using cards issued by banks in Nordic countries having the euro as the home currency. For example, when we travelled to Israel where the currency is the Israeli New Shekel (a non-euro currency), Curve converted transactions made in this foreign currency into euros using the current exchange rate and transferred the payments to the selected underlying card. No percentual conversion fee was added on weekdays. We have had Curve as our primary payment card during our travels in Croatia, Turkey and Israel. We have saved 1 - 2% of our daily budget thanks to the cheaper currency conversions.

Curve has limits: general usage and ATM withdrawal limits and a limit for discounted currency conversions. After Curve knows the customer better, some of the limits may increase but most likely, the currency conversion limits stay the same. In addition, the limitations set in the linked payment cards are naturally valid.

Free Cash Withdrawal

With the free version of the Curve card, you can withdraw money from ATMs for at least £200 within a month without cost.

However, this advantage can be a trap. Although Curve does not charge ATM withdrawal fees, some ATMs may ask for withdrawal fees. Therefore, it is important to check carefully whether the withdrawal transaction is free or not before proceeding from such ATMs. If you want to avoid withdrawal fees, be patient to check other automated teller machines that allow free withdrawal as you will always find them quickly from place to place.

Since Curve needs to transmit the transaction details to another card, the issuer of this card may charge for withdrawals. When you use ATMs with a Curve card, it is important to direct the transaction to a card that does not ask for fees when using ATMs. A good choice is, for example, a credit card from Bank Norwegian that does not charge you for using the ATM.

Curve Protections

Like every existing credit card, Curve card offers protection to its card users. For example, when we travelled to Krakow, Poland, we had a small problem while paying for the dining. Ceasar made it clear twice to the restaurant staff that he pays in Polish currency, the Poland zloty. Thanks to the real-time report of transactions, Ceasar got a notification of such payments through the Curve app. We approached the cashier and asked her to kindly correct the payment, by shifting the chargeable amount to local money instead of GBP. She repeatedly said she couldn't do anything to make changes to this transaction. Ceasar then contacted Team Curve via email. After a few conversations, we were happy to get a positive response from Curve:

...Thanks for sending this through.

The dispute process is quite lengthy and not always successful. Due to the value of the transaction, we would like to refund you as a gesture of goodwill.

We can see that without the merchant's exchange rate, the 110 PLN would be 23.08 GBP. We would, therefore, like to refund you 1.85 GBP directly...

From such a quick and helpful response from Team Curve, we felt like they value every single customer they have.

Google and Apple Pay

Curve is a modern card so it supports Google and Apple Pay. That means, it is enough to have your phone with you. No physical card is needed.

Smart Rules

With Smart Rules, you can automatically select which payment card to use based on pre-defined conditions. For example, you can use your main payment card for groceries and another card for travel expenses. Smart Rules are just simple conditions. If they are true, the transaction will be directed to the card mentioned in the rule.

Future of Curve

Curve is still a young product and it is continuously developing and becoming a global brand. We have heard that there are new handy features to be launched.

Curve Credit

Curve is testing a credit feature in the UK. After the test phase, the feature will be launched in Europe and the United States. As we are not living in the UK, we have not been able to try this feature yet.

Curve Subscription Levels

Curve

The features we mentioned above are included in the free Curve card. It doesn't cost anything except the delivery to avail of this card, and there is no monthly charge for card usage. Curve is a perfect choice for trying the features.

You can only add 2 payment cards to the free version of Curve. Also, the spending limits are lower and only 1 Smart Rule is possible.

Curve X

Curve X is a little better version of the basic Curve. The delivery is free but the monthly fee is about 5 pounds. Curve X supports 5 payment cards and it has higher spending limits. You can also create multiple Smart Rules.

Curve Black Card

There is also a paid version of Curve with a lot more features: Curve Black. The acquisition of this card does not cost anything, but there is a monthly fee of €9.99. The card has the same features as the Curve Standard card and a few extra features:

- Higher ATM withdrawal limit up to £400 per month

- The card includes travel insurance.

- The card includes electronic gadget insurance.

- 1% cash back at 3 selected retailers

The minimum subscription period for Curve Black is 6 months. By paying 12 months in advance, you will get a discount.

Curve Metal Card

Curve Metal is the best subscription in terms of card benefits. It costs £14.99 monthly.

Curve Metal has a few more perks.

- As the name says, the card is made of metal.

- Spending limits are even higher.

- The card has travel insurance, electronic gadget insurance and a rental car collision damage waiver.

- 1% cash back at 6 selected retailers

- Visits LoungeKey airport lounges for a discounted rate

The minimum subscription period for Curve Metal is 6 months. By paying 12 months in advance, you will get a discount.

Curve Cash

Curve Black and Curve Metal are giving 1% cashback called Curve Cash from purchases made at selected retailers. Curve Black users may select 3 retailers and Curve Metal holders 6. The list is long including for example Amazon, Shell, Lidl, Booking.com etc. The payback is paid by Curve and you will still get possible bonus points from the underlying cards.

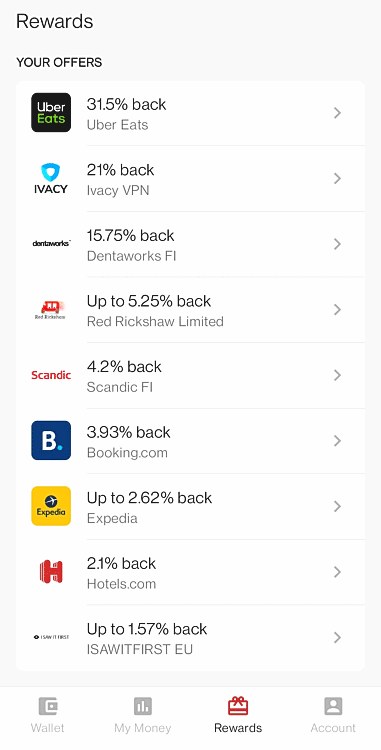

Curve Rewards

Curve has slowly been introducing Curve Rewards. In this bonus program, Curve is partnering with local and international brands which are paying back additional bonuses from the purchases paid with a Curve Card. The bonus is paid as Curve Cash. The feature is available for all Curve users.

In Finland, the Curve Rewards partners contain hotel booking sites and a few other retailers. The exact selection varies between the countries.

Paying with Curve Cash

Curve Cash is collected to the Curve application. It can be used to pay for any purchase in the same way as using any payment card linked to Curve. However, to pay a purchase with Curve Cash, you need to have Curve Cash for the whole amount of the payment.

It is also possible to use Curve Cash automatically by turning the feature on. Then, Curve Cash will always be used when the payment amount is less than your Curve Cash balance. Otherwise, the user-selected payment card will be used in the normal way.

Curve Safety Features and Insurances

Curve subscriptions have safety features, insurance and protections. In the Curve App, you see all transactions in real time. The card can be temporarily locked on the application and opened as easily. Therefore, following your transactions and spending in real-time is easy with the Curve App.

When using the card on the internet, Curve authenticates the user strongly. Authentication happens with a PIN code sent by SMS to the user´s phone or via the Curve App.

Customer Protection

Curve Customer Protection protects you against unsuccessful or fraudulent purchases. Fraudulent or otherwise unauthorized transactions will be refunded. You may also ask for a refund if you have not received the purchased item or the service or if there have been some quality issues. The exact terms are complicated and we recommend you check them on Curve´s website.

For example, if you have booked flights but the airline goes bankrupt before the travel dates, you may be allowed a refund.

Travel Insurance

Curve Black and Curve Metal include travel insurance provided by AXA Travel Insurance.

The travel insurance covers medical expenses and your belongings with a small excess. Check the terms carefully to find out if the insurance is good enough for your travelling habits.

Electronic Gadget Insurance

Curve Black and Curve Metal include electronic gadget insurance. The insurance covers, for example, tablets and laptops. .

Electronic Gadget Insurance is a part of travel insurance.

Rental Car Collision Damage Waiver

Curve Metal´s travel insurance also covers a rental car collision, damage or theft.

Usually, insurance terms are complicated so you must read them carefully. We are not giving you any advice if these Curve insurances are suitable for you.

Our Way to Use Curve Card

You may have been wondering, which payment cards we have linked to Curve. The optimal combination depends on your location and most likely, our model does not work for you. Anyway, we tell it briefly.

We pay almost all our daily spending and purchases with Curve. We have linked Bank Norwegian Visa Credit and Nordea Mastercard Debit/Credit to our Curve Apps. Bank Norwegian Visa is especially a good choice because it gives 1% cashback usable for Norwegian Air Shuttle flights, it has free ATM withdrawals and no monthly fee. Nordea's Mastercard does not have similar perks, but as our main bank provider, it is a good backup card.

Rating

Curve Card together with the Curve App makes directing transactions to different cards easy. You will also stay aware of your spending habits. Our Curve cards have technically been working almost perfectly and the customer service has been good but sometimes a little slow.

Currently, we have subscribed to Curve Metal level with nice extra features. The level offers insurance, a LoungeKey membership and a cashback feature. These are really useful perks while travelling but are not unique among payment cards.

We rate Curve as a 4-star card based on our own experiences.

Common Questions

- How does a payment transaction made with a Curve Card appear on the underlying card?

- When Curve transmits payment to the linked card, the name of the merchant for the purchase is displayed in the account's transactions, but the information also shows that the payment transaction has arrived via Curve. For example, CRV*KFP MYYRMAKI OY -9.90.

- Are underlying card insurances valid when paying with the Curve?

- Many credit cards have valid travel insurance when you pay the majority of the travel costs directly to the said card. It´s better to contact the card issuer and ask about their terms.

- Is Curve safe?

- The curve has all modern security features like other payment cards.

- Who is responsible for the misuse of the Curve card?

- If your card has been misused or there appears a wrong charge, you need to make a reclamation to the card's issuer. The question is whether to direct it to Curve or the underlying card's issuer. We asked Curve's customer service and they replied that Curve will be the first contact point in the case of any Curve payment issue.

- Does Curve support American Express (Amex)?

- Unfortunately, not anymore.

Where to Order Curve?

It is easy to acquire your Curve card. You just need to install Curve App to your phone. The card can be ordered via the app and it will be delivered to your home in 2 weeks. Before that, you can start using Curve Card with a virtual card available from the app.

Curve Black and Metal give a 1% bonus on purchases from selected merchants. The merchant list includes among others: Lidl and Shell. In other words, you get a one per cent bonus for all Lidl purchases. The bonus accumulates as Curve Cash, and it can be used later to pay for purchases.

Download Curve App via our referral link and you will get a welcome bonus if there is an active campaign.

Curve in the USA

Curve card was launched in the United States in 2022. The Curve US Credit Card is issued by Hatch Bank.

Bottom Line

According to our Curve review, Curve is an excellent payment card among travellers whose destinations are using a different currency from one's home currency. As a free card, Curve Standard brings clear savings in currency conversion costs. The card is also suitable for those who travel for work with credit cards from different banks. In addition, Curve is also a great choice for daily spending. As a basic rule, when using credit cards, one needs to spend wisely when using Curve cards too.

Since Curve Standard is completely free, trying it yourself is the easiest way to find out the suitability of this card.

Are you a Curve card user? Comment on your experiences below.

Add Comment

Comments (2)

How about curve vs wise cards? It looks like there is good competition between the two on forex.

Thanks for the comment.

Wise card is an excellent product. We use Wise to transfer money between different currencies and pay bigger foreign currency charges.

However, Wise and Curve are a little different. Curve is great for daily spending with its extra features. Currency conversion is often free. Wise is better for money transfer and storing foreign currencies. Fees are really low. We recommend having both the said cards.

Excellent review. I wrote a review on my blog if anyone is interested. One thing that put me off is after so many transactions/ or a certain amount you need so send Curve a copy of your ID. However, Curve doesn't bother to tell you this, until you are making a payment and it does not work. I've also had a few declined transactions. Once they sort this out it will be a great service. The metal card is beautiful too... but not sure if it's on the expensive side.

Thanks for the comment, Hohn.

I read your review too and you had many good points. Especially, the protections of underlaying cards are in the grey area and users are missing American Express support.