Review: Wise -the Best Money Card For Travellers?

The content on this page includes affiliate links. While clicking on these links won’t cost you anything extra, we may earn a modest commission from any purchases.

Wise is a solution for travellers, nomads and immigrants needing a multi-currency account. With Wise, you can transfer money safely, exchange currencies at the best rate in the market, and spend the currencies in your account with a Wise debit card. The fees involved in Wise are relatively lower than those of its competitors. Read more from our Wise review.

Covered in the Article

What is Wise?

Wise is a payment service founded in 2011. Wise's speciality is international money transfers, with the company's mission to offer affordable, fast, and easy payments to all people across different borders. Wise allows you to hold multiple currencies and offers convenient, cost-effective currency exchange compared to traditional banks.

Initially, the company was from Estonia. Today, the head office is in London, Great Britain.

Wise is invaluable for immigrants sending money home and employees receiving foreign salaries. While Wise started as a money transfer service, its concept and target audience have evolved. Today, Wise is more than just a money transfer service; it's a multi-currency bank tailored for global nomads and travellers. In addition, Wise's product range also includes a debit payment card, which makes spending foreign currencies practical.

The basis of Wise's service selection is a Wise application, which currently supports numerous currencies.

How Does Wise Work?

Wise allows its users to transfer money internationally quickly and cheaply. Money can also be spent with a debit card.

If you are unfamiliar with Wise, you might be wondering what Wise's operation is based on and how this company can offer its customers cheaper and faster international money transfers than conventional banks and its competitors offering similar services.

We explain briefly the platform's operation and its perks.

Fast Cross-Border Money Transfers

One of the main factors behind Wise's low costs and fast transfers is that Wise's money transfer does not cross borders. Wise's speed and low costs are based on the fact that the company has its bank account in every country it supports. When you transfer money to a family member, a friend, or a colleague living abroad, you are not dealing directly with them at any point.

You can directly receive traditional bank transfers to your Wise account in major currencies. Additionally, you can easily send money from Wise to accounts at traditional banks. Wise provides a modern solution for international money transfers, making it easy to send funds across borders.

Wise Debit Card

The physical Wise Visa Card is a debit card that can be ordered for 7 euros. A virtual card on the application is free of charge.

The Wise debit card can be used to make payments in any store and on the internet in almost all countries, with a few exceptions. The money is transferred to the payee from the user's Wise account. If the user does not have the target currency deposited in their account, Wise handles the currency conversion to the target currency much cheaply than conventional banks' fees. Thus, using a Wise debit card abroad is cheaper than using cards issued by conventional banks.

Wise supports Apple and Google Pay, so a virtual Wise Visa is enough to make store payments.

Wise debit card is a practical travel aid for holidaymakers and nomads. Because you can deposit and hold money in your Wise accounts with many different currencies, can exchange money when the rate is the best - even before a journey. At the destination, you withdraw money from an ATM with the Wise debit card or pay directly at the store. This way, you spend like a local since the currency has already been exchanged.

A Wise debit card is especially suitable for those who travel a lot, as its most significant advantage is that the currency exchange costs using Wise are cheaper than conventional banks' fees. You can even exchange the currencies before the travel.

Benefits of Using Wise

The advantages of Wise are realised, especially when you use a currency different from your home currency.

Money Deposited in Different Currencies

Money can be deposited into Wise in almost any currency. For certain currencies, the user also receives a genuine bank account number for receiving bank transfers from outside Wise. Standard bank transfers can be received in GBP, EUR, USD, AED, AUD, BGN, CAD, CHF, CZK, CNY, DKK, HKD, HUF, ILS, JPY, NOK, NZD, PLN, SEK, RON, SGD, UGX and ZAR. Only account transfers out of Wise are possible for other currencies.

Money can also be deposited in jars where they are locked out from spending. This is a way to separate the daily needed money and savings.

Earning Interest

Money in a Wise account does not typically earn interest. However, with euros, pounds and dollars, you can choose to hold your money as regular currency or government-backed assets via a fund. If you select the latter option, you will earn about 2 to 6 per cent interest on your money while you can still spend the money as usual. The exact interest rate is variable. This benefit comes with a drawback. Your capital is at risk even though it is low.

Cheaper Currency Conversions

Banks usually charge a fee of up to 3 per cent for currency conversions. Wise charges less than 0.5 per cent for several currency pairs, less than banks. Wise is an affordable way to exchange currencies.

Money Transfers to a Foreign Account

Through the Wise application, you can send money abroad even in those currencies where money cannot be held in Wise. In this case, it is sufficient that the recipient has a bank account in the country to which the money is to be sent.

Money Transfers from Abroad

You can receive normal bank transfers to your Wise account in the most well-known currencies. You get genuine bank account numbers to which money transfers can be directed.

Topping Up Wise Accounts

Wise offers various payment methods to top up Wise accounts. Direct bank transfer and open banking are the most affordable options. Debit/credit card and Google Pay payments incur slightly higher fees. Other payment methods are also available. Some methods are instant, while cheaper ones might have a short delay.

Cost of Using Wise

Installing the Wise application, creating a user account and opening bank accounts with a free virtual Visa card is free.

Currency Conversion Fees

Wise supports currency conversions between more than 50 different currencies. The costs of currency conversions vary between different currency pairs. At its most affordable, the currency conversion costs only 0.41 per cent of the amount to be converted. You can check the latest currency conversion costs with the calculator on Wise's website.

Payment Fees

Paying with a debit card is free of charge. However, if there is a currency conversion involved, it may cost extra. In rare cases, a merchant also charges for card payments.

ATM Fees

With the Wise debit card, you can withdraw cash from your Wise accounts up to 200 euros per month without any cost, but withdrawals are limited to no more than two instalments. The third withdrawal or excess of the monthly limit of 200 euros will cost 1.75% of the amount exceeding 200 euros and a fixed fee of 0.50 euros per withdrawal.

Wise's payment card automatically uses the local currency in your account, if possible. Otherwise, the card performs an automatic currency conversion at the real rate at a low (from 0.41%) cost.

Prefer paying directly at a store rather than withdrawing money from an ATM since the ATM limit is low. Reserve your cash for payments in places where only cash is accepted.

Transfers

Transferring money from a Wise account to your regular bank account is free of charge if no exchange is involved. It is also free to transfer money to other Wise users.

There are fees if the transfer requires a currency conversion or when you add a balance to your Wise account using card payments or another fast method.

Adding funds is usually free if there's no currency conversion and you select the cheapest transfer method.

How We Use Wise?

When we travel outside the eurozone, we always travel with our Wise Debit Visa cards, with which we make payments like a local with the already exchanged money on our Wise account.

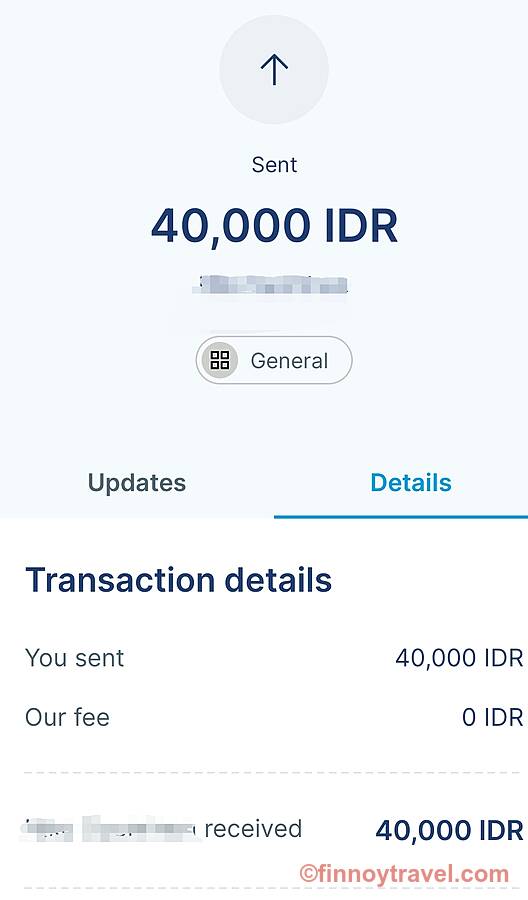

For example, a few months before our travel to Indonesia, we had been monitoring the daily exchange rates of the euro to the Indonesian Rupiah. We topped up our Indonesian Rupiah account whenever the exchange rate was reasonable. The money in the local currency was then available in our multi-currency account, ready to be spent even before we arrived at our destination in Bali.

Wise's Competitors

Aside from Wise, competitors in the market offer similar services. We have tried using other remittance companies like Western Union online banking, Worldremit, and Remitly. Honestly, Wise stands out among the rest. The better exchange rate and lower transfer fees of Wise mean some savings.

Wise vs. Curve

Wise and Curve are similar in some ways, but they offer distinct advantages for cardholders. Both are among our top picks for travel

Wise allows you to withdraw foreign currency abroad up to 200 euros free of charge. Transferring money to another Wise account in the same currency is also free of charge, and the transaction is completed instantly. This is useful when travelling together with someone, and you need to split the amount of your spending.

You can use a Wise debit card free of charge while abroad only if you choose to pay in the local currency from which the transaction will be deducted from the held money in your account.

Curve is a mobile wallet that lets you add multiple credit and debit cards to your account and easily switch between them for payments. Unlike Wise, Curve offers four subscription tiers. The amount you can withdraw from ATMs for free depends on your subscription. For example, the free tier doesn't allow any free withdrawals. Higher subscriptions increase the free foreign ATM withdrawal limit to 400-600 euros/pounds. Withdrawals exceeding this limit incur a small fee.

When adding your payment cards to Curve, be mindful of potential fees charged by your card issuers for cash withdrawals. To fully benefit from Curve's free foreign ATM withdrawals, ensure your underlying card issuer doesn't charge ATM withdrawal fees. Curve handles currency exchange for foreign ATM withdrawals and purchases at a Mastercard exchange rate without adding extra costs. This means you can avoid the currency conversion fees typically charged by card issuers

Both Curve and Wise offer affordable currency conversions. However, they complement each other well. Curve offers numerous features for travellers, while Wise is ideal for holding multiple currencies and receiving bank transfers. We recommend using both, but they're not designed to be used together.

Is Wise Safe?

The answer is yes. Since Wise is not a bank, it has no government guarantee for the money. Wise keeps funds in traditional banks, but these funds are separated from Wise's money. Therefore, even if Wise declares bankruptcy, customers' money would still be kept in custodial banks in separate accounts. The money can only be lost if the banks are insolvent, which rarely happens.

Since the Wise Visa card is a debit card and not a credit card, you can never spend more money than what you have in your Wise account. This is why the Wise Visa Card is very safe for anyone, as there is no risk of overspending more than the money you have in your Wise account.

Rating

We rate Wise as a 5-star application for travellers. The service is affordable and does not have recurring fees. Currency conversions are cheap, exchange rates are better, and you can hold money in different currencies in your Wise bank accounts and spend it later. In addition, you can spend money easily with a Wise debit card.

Common Questions

- What is Wise?

- Wise is a service that transfers cross-border money, holds money in different currencies, and allows you to spend it with a Wise debit card.

- Is Wise only a money transfer service?

- No, it is not. See the previous answer.

- Is using a Wise debit card free?

- Paying with a Wise debit card does not cost anything. However, if a currency conversion is needed, there is a small fee.

- Can I hold different currencies in a Wise account?

- You can exchange currencies whenever the rate is reasonable and hold the money in your Wise account.

- How does Wise make money?

- There are fees to add money to your Wise accounts. Also, currency conversion costs.

- Why use Wise?

- There are two natural reasons: It is practical, and the fees involved are low. The costs are also clear and transparent.

Bottom Line

Having tried different international money transfer companies, Wise's exchange rate has always been the best in the market, while currency conversion fees are lower than those of conventional banks. We always use Wise Debit cards when we travel, and whenever we need to transfer money to a foreign account, we do so via Wise.

The Wise app is user-friendly for managing your Wise account. One can open a multi-currency Wise account for free, which you can top up for future use or accept payments with different currencies. Therefore, we recommend using a Wise Debit Visa Card for travelling as it has low conversion fees and zero transaction fees while paying in the local currency of your destination from your multi-currency account.

Are you already using Wise? Share your thoughts below.

Add Comment

Comments